When the news of Aga Khan moving his headquarters to Portugal was broken to the Ismaili community, no one exactly knew why the move was made. However, the only thing which each and every Ismaili was taught to say was how ‘great’ Portugal was, and that it was now the new ‘home’ to Aga Khan’s Imamate.

Nonetheless, some Ismailis did wonder that why didn’t Aga Khan move his global headquarters to Canada, which not only he has promoted as the new home for his followers, he is also an honorary citizen thereof. He also enjoys close ties with both – Justin Trudeau’s Liberals, as well as Stephen Harper’s Conservatives. Canada also hosts the Aga Khan Museum and the Global Center for Pluralism.

Canada would have been the perfect place for the Aga Khan to move his headquarters, or would it?

The reality is, that in recent times, Aga Khan’s name has been in the Canadian media. As opposed to Europe where his name is usually in the media due to his race horses, multi-million dollar divorces and court settlements, the focus here, has been his fortune, tax breaks, and business dealings.

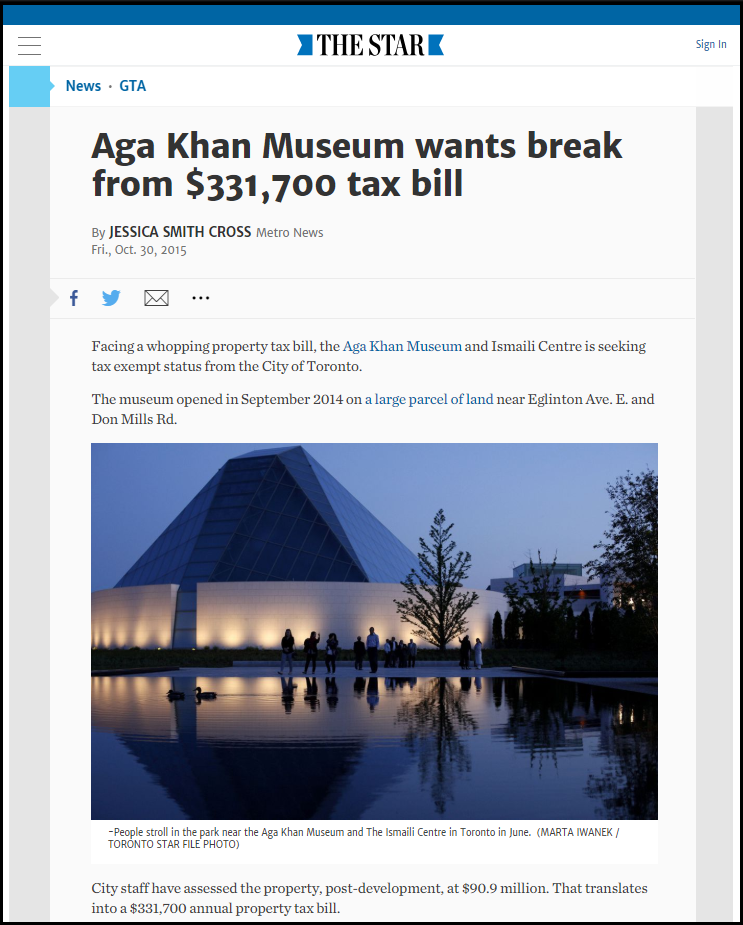

The Aga Khan Museum’s Tax Break

The first huge debate in the Canadian media was about the tax deal which Aga Khan got for the Aga Khan Museum. Toronto city staff assessed the property at $90.9 million, which translated into a $331,700 annual property tax bill. Aga Khan wanted to pay none of it – ever. Due to a prayer hall being part of the property, the property had already been exempted $43.1 million from the base value, Aga Khan also wanted the rest of the property to be exempted. On September 30, 2015, Aga Khan requested support of Toronto City Council to obtain private provincial legislation that would exempt the property valued at $90.9 million dollar property of Aga Khan Museum from municipal and education taxes. This exemption which was supported by the Mayor, costs the government an annual $331,700 and to-date has benefited Aga Khan over a million dollars having availed this exemption for over three years.

Aga Khan Foundation Canada’s Lack of Transparency

When it comes to Aga Khan Foundation Canada (AKFC), the Toronto Star blamed it for for “lack of transparency” and as one of the charities which do not release their audited financial statements to the public and refused to provide them to an independent agency that evaluates charities. AKFC was investigated by charityintelligence.ca and it was revealed through Canada Revenue Agency that that AKFC had accumulated so much donations without spending them that they had enough cash-in-hand to operate “for up to 8 years without raising even a single penny.” Moreover, they had a heavily paid CEO with a salary of $350,000 to $400,000 per year. Also, AKFC held significant ‘idle’ property valued at $346.2m in F2013, including $27.3m acquired in F2013 and $43.3m in F2012.

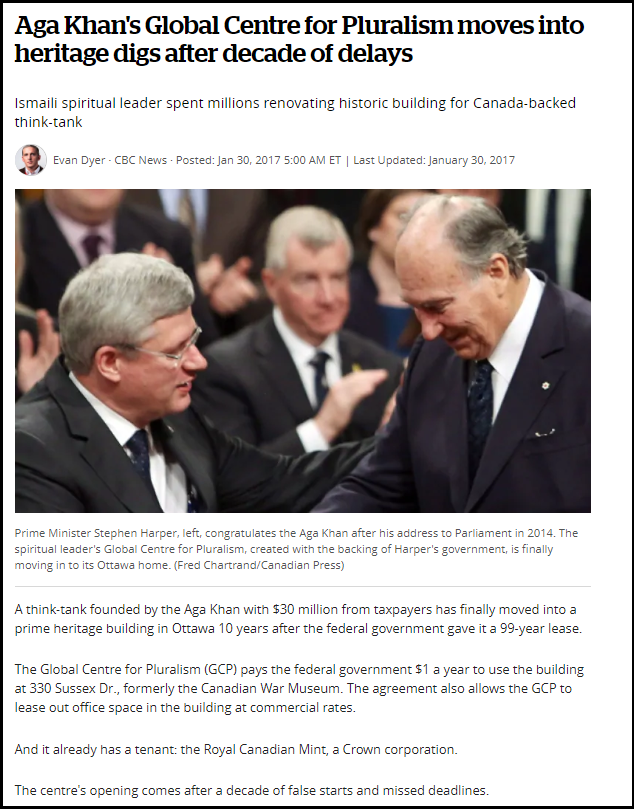

The Global Center for Pluralism Scam

Aga Khan was also highly criticized when he milked the Canadian government to grant him $30 million dollars from the tax payers money to establish the Global Center for Pluralism (GCP). He got the prime piece of real estate, which was formerly the Canadian War Museum for just $1 for a 99-year lease. That wasn’t enough, he later got permission for sub-leasing half of the property at market rate to other tenants, which is generating a handsome income for Aga Khan and the GCP. According to CBC, the only thing which GCP does is that it “hosts an annual lecture and awards ceremony, as well as an annual roundtable discussion. It has also produced some reports and papers, with a focus on Kenya and Kyrgyzstan.” This has obviously irritated the Canadian taxpayers and question the entire policy of cooperation at the state level with the Aga Khan and his institutions, and most importantly, if the $30 million given to the GCP from the tax payers money as well as the lease of the multi-million dollar property for 99 years at just $1 is justifiable?

Snapshot of the CBC report which revealed that Aga Khan paid just $1 for the 99-year lease of the Canadian War Museum site for Global Center for Pluralism and then got permission to rent it out at market rates to Government of Canada itself, with the Canadian Royal Mint being the first tenant.

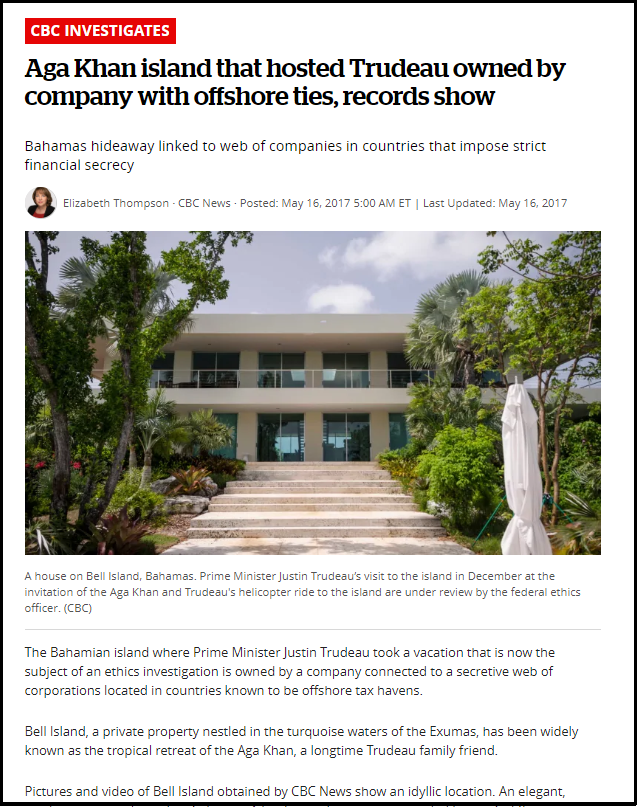

Aga Khan’s Connections to Off-Shore Tax Havens

Aga Khan’s name came to surface again as a part of an ethics probe when Prime Minister Justin Trudeau flew in Aga Khan’s private jet to one of the islands in the Bahamas owned by the Aga Khan. When the investigators hit the ground, they found that not only the island in Bahamas, but also Aga Khan’s aircraft which carried Justin Trudeau and his family to Aga Khan’s island – both were registered in the name of off-shore companies. The same notorious off-shore companies which the global capitalist elites use to conceal their wealth. These companies have several layers of ownership – such that each company is owned by another company – which is owned by another company – all registered in different off-shore tax havens such as the British Virgin Islands, Jersey, Bermuda, Panama and Cayman Islands – under strict privacy agreements – making it virtually impossible to trace the real ownership of these assets worth billions of dollars.

CBC investigative report revealing that Aga Khan’s assets which came under scrutiny during the Trudeau vacation scandal were under the ownership of offshore companies whose names were leaked in Paradise Leaks.

Money Laundering

Aga Khan had a fair share of trouble on the southern end of the Canadian border too, as in the eyes of Federal Buearu of Investigation (FBI) and Internal Revenue Services (IRS), Aga Khan’s name is closely linked to the million-dollar ‘religious’ money laundering case of 1990’s, which still has unclaimed money lying with the IRS. All clues have pointed to the fact that Aga Khan was the one smuggling tithe money (which Ismāʿīlis call dasond) across the US-Canadian border with the help of top-ranked Ismāʿīli community officials. The entire case was exposed by the Canadian Broadcasting Corporation (CBC) in an episode of their long-running weekly investigative program ‘The Fifth Estate’, in the episode titled ‘Gods Money’. 11 members of the Ismāʿīli community were caught red-handed in that case, took all the blame upon themselves and Aga Khan narrowly escaped indictment in the case.

With all of the above baggage, it wouldn’t have been a wise decision at all for Aga Khan to move to the North American region at all. But the question is, why did he leave France?

The French Connection

France had been the headquarters for Aga Khan for a number of years. The decision to leave France was taken in the making when Aga Khan had obvious difficulties in maintaining equal relations with both the French political parties – the conservative UMP and Socialist Party.

‘Exceptional Tax Breaks’ from Nicolas Sarkozy

Nicolas Sarkozy, who gave him exceptional tax breaks using his “executive orders”, the opposition party wasn’t too keen on upholding that status and was looking to revoke tax exemptions extended to Aga Khan, as all of Nicolas Sarkozy’s decisions and tax breaks had been linked to corruption cases.

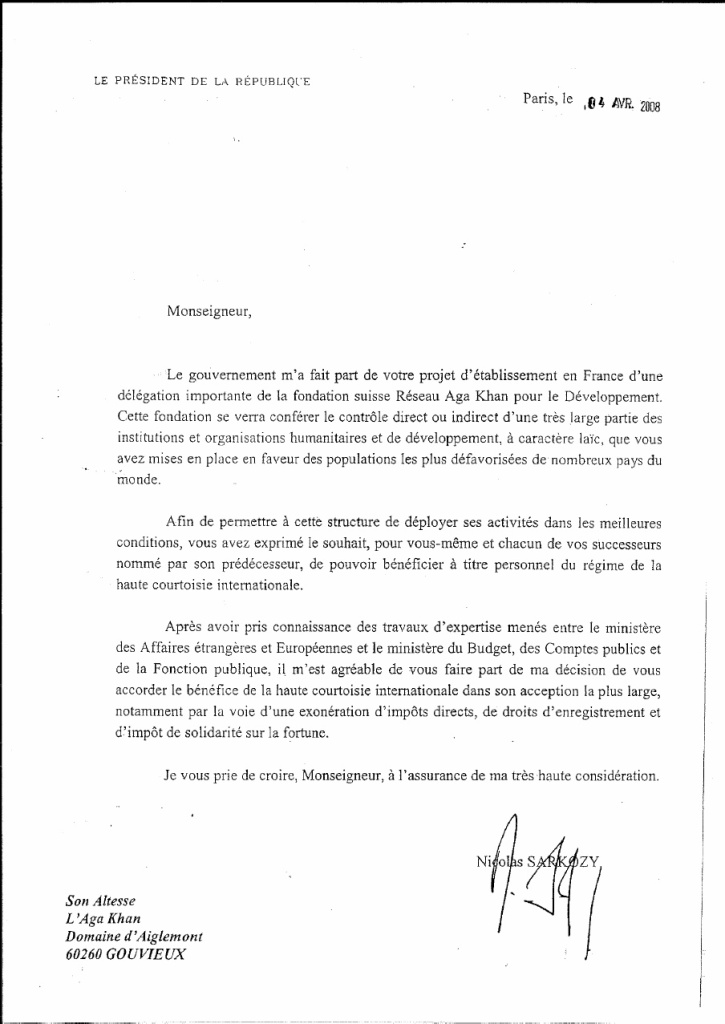

For example, in March 2012, a major criminal investigation into the affairs of L’Oréal heiress Liliane Bettencourt, established that at least 800,000 euros were funded from her secret Swiss bank accounts to Sarkozy’s election campaign in return for future tax breaks for the L’Oreal heiress. Later in July 2014, Sarkozy was put under official investigation for “active corruption”, “misuse of influence” and “obtained through a breach of professional secrecy”. Sarkozy had misused his political position as the president to issue the following tax exemption to Aga Khan:

Letter signed by Nicolas Sarkozy exempting Aga Khan from all kids of taxes.

In the above letter, which was leaked as a result of a corruption inquiry, Sarkozy gave the Aga Khan “exemption from direct taxes, stamp duty and wealth tax”. The French media soon stepped up and exposed Aga Khan’s business empire, calling Sarkozy’s favor an “extraordinary tax gift” and calling Aga Khan the “Golden Imām” for “his taste of private jets, luxury yachts and upscale ski resorts”. French paper “Regards” mentioned that Aga Khan is “head of a financial empire that controls worldwide companies with various activities: banking, telephony, hospitality, air transport and energy” and that Aga Khan is known to “celebrity gazettes for his passion for horse racing and expensive divorces” and therefore the tax exemption to such a rich person was unjustified.

Four years after exempting him from paying taxes, Sarkozy also played a key role in negotiating a divorce deal for Aga Khan , and took on the case when Aga Khan was ordered to pay GBP 54 million to his wife Gabriele Thyssen (also known as Inaara Aga Khan). The original appeal decision, made by a court in Amiens, had attributed all responsibility for the marriage breakdown to the Karim Aga Khan, after ruling that his affair with an airline stewardess, Beatrice von der Schulenburg, was to blame.

Aga Khan with his latest girlfriend, Beatrice von der Schulenburg – possibly his third wife.

Sarkozy’s fall came sooner than Aga Khan would have predicted, but Aga Khan had already found a safe haven in Portugal where the tax treatment he would receive would be predictable and the ruling authority would treat him consistently whether or not the government would be with the Socialist Party or with the Social Democratic Party. When Aga Khan’s news of his move to Portugal broke out, Portugal’s Foreign Minister Rui Machete of the Social Democratic Party mentioned that this move had materialized after six years of negotiations.

The Portuguese Solution

Aga Khan purchased the Mendonça Palace, located right in the center of Lisbon for 12 million euros and has promised to invest 10 million euros in the Portuguese economy.

The move to Portugal is more than anything, a smart business move. While at his French headquarters, Aga Khan did receive a lot of favors from Sarkozy, the deal with Portugal was much sweeter and importantly, not at the risk of reversal by either of the ruling parties.

The agreement gives Aga Khan the status of a diplomat and gives Aga Khan the freedom to to transfer all of his global assets to Portugal (and from Portugal to the outside world) without any restrictions. Under Article 12 “Funds, foreign currency and assets”, it mentions that Aga Khan “may hold funds, securities, gold and other precious metals, or foreign currencies.” It also mentions that Aga Khan “shall be free to receive any such values from within or from outside Portugal and hold and transfer the same within Portugal or from Portugal to any country and to convert any currency held or bought into any other currency.”

Tax exemptions are obviously there exempting Aga Khan from any kind of national and local tax, including transfer or capital gain tax, income tax, wealth tax and stamp duty. Moreover, all gifts and donations given to Aga Khan will be tax deductible. Aga Khan will also not pay any duties on the purchase, ownership, registration, use or sale of land, air or sea vehicles, including spare parts and consumables. Any value-added tax which the Aga Khan would pay, would be fully refundable to Aga Khan.

Under the agreement, Aga Khan would also enjoy ceremonial diplomatic treatment which is given to foreign high entities. He would also be immune from any judicial action and legal proceedings. He also negotiated similar treatment for his family members and senior officials working for him.

The above diplomatic status and tax exemptions would have been impossible to achieve in an open democracy like Canada and would have only been possible in a country like Portugal – which is described as a ‘flawed democracy’ by the Economic Intelligence Unit of the Economist Group.